Primary Packaging Labels Market Size, Trends, Segments, Share and Companies 2025-35

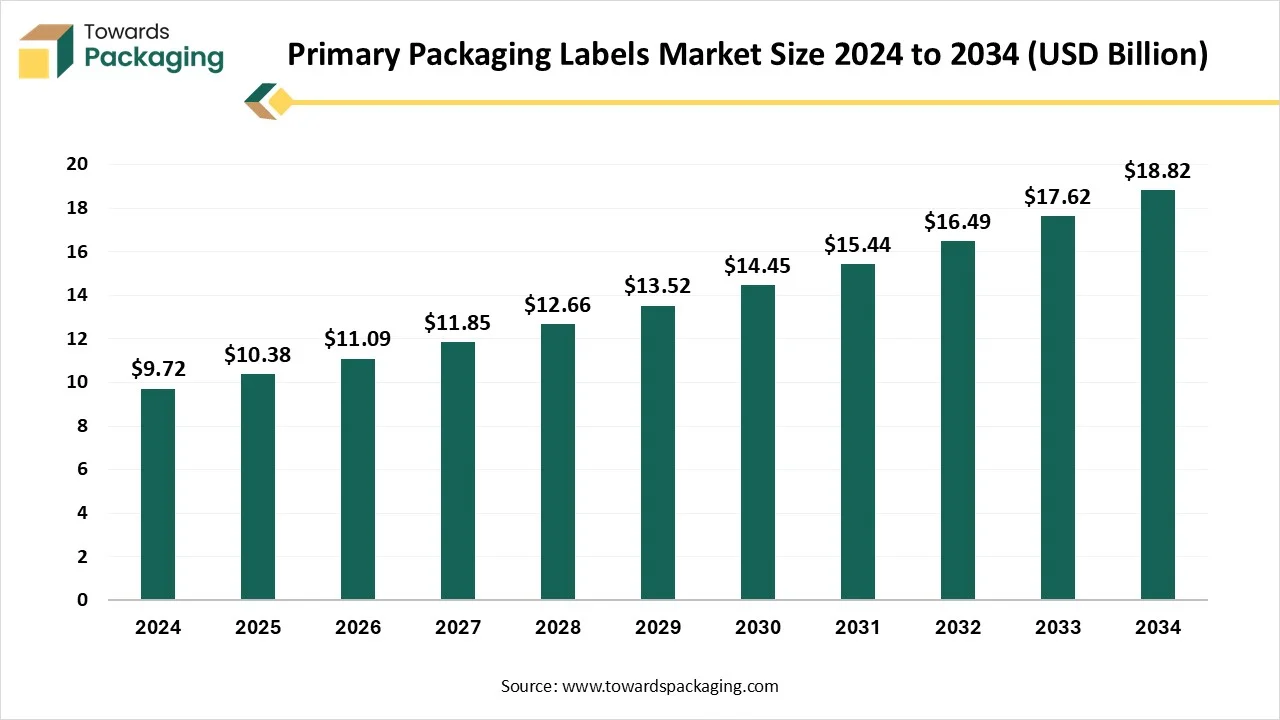

According to researchers from Towards Packaging, the global primary packaging labels market, estimated at USD 10.38 billion in 2025, is forecast to expand to USD 18.82 billion by 2034, growing at a CAGR of 6.83% over the forecast period.

Ottawa, Nov. 14, 2025 (GLOBE NEWSWIRE) -- The global primary packaging labels market was valued at USD 10.38 billion in 2025 and is expected to grow to USD 18.82 billion in 2034, as noted in a study published by Towards Packaging, a sister firm of Precedence Research.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Key Insights

- Asia Pacific has dominated the primary packaging labels market, having the biggest share in 2024.

- North America is expected to rise at a notable CAGR between 2025 and 2034.

- By material type, the paper-coated paper segment has contributed the largest share in 2024.

- By material type, the plastic/synthetic PET segment will grow at a notable CAGR between 2025 and 2034.

- By printing technology, the flexographic printing segment contributed to the largest share in 2024.

- By printing technology, the digital printing segment will grow at a notable CAGR between 2025 and 2034.

- By type of label, the self-adhesive/ pressure-sensitive label segment contributed to the largest share in 2024.

- By type of label, the shrink sleeve labels segment will grow at a notable CAGR between 2025 and 2034.

- By application/end use industry, the pharmaceuticals segment contributed the largest share in 2024.

- By application/end-use industry, the cosmetics and personal care segment will grow at a notable CAGR between 2025 and 2034.

- By packaging type, the bottles segment has contributed the largest share in 2024.

- By packaging type, the blister packs segment will grow at a notable CAGR between 2025 and 2034.

Key Technological Shifts

| Technology Area | Current Trends | Impact/ Benefit |

| Printing Technology | Digital printing is growing alongside traditional flexography | Enables short runs, personalization, and variable data |

| Materials | Shift from paper to synthetic & biodegradable substrates | Improves durability, premium look, and sustainability |

| Label Types | Rise of shrink sleeves, full body, and smart labels | Better branding, consumer engagement, and tracking |

| Smart Types | QR codes, NFC, and RFID integration | Enhances traceability, interaction, and anti-counterfeit |

| Sustainability Features | Linerless labels, eco-friendly adhesives | Reduces waste and improves recyclability |

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5775

Key Government Initiatives in the Primary Packaging Labels Industry:

- Extended Producer Responsibility (EPR) Schemes mandate that companies are financially responsible for the post-consumer collection, sorting, and recycling of their packaging.

- The EU Packaging and Packaging Waste Regulation (PPWR) is a comprehensive regulation requiring all EU market packaging to be fully recyclable by 2030 and meet recycled content targets.

- Mandatory Labeling for Recyclability/Disposal requires clear, harmonized on-pack instructions to inform consumers on how to sort and dispose of packaging materials correctly.

- Plastic Packaging Taxes penalize packaging that does not meet a minimum threshold of recycled content, encouraging the use of sustainable alternatives.

-

Food and Drug Administration (FDA) Regulations enforce strict guidelines on labeling for safety, ensuring accurate ingredient disclosure and traceability for consumer protection.

Market Outlook

- Industry Growth Overview: The primary packaging labels market is growing steadily due to regulatory requirements, brand differentiation, and increased demand for packaged goods. Although paper labels continue to be the most common, digital printing and synthetic labels are expanding quickly, particularly in developing regions.

- Sustainability Trends: Brands are adopting recyclable, biodegradable, and linerless labels because of sustainability. Eco-friendly adhesives and minimalist designs are becoming popular, and smart labels are made to be recyclable.

-

Startup Ecosystem: Startups are innovating in smart labels, sustainable materials, and digital printing for customization. They often partner with larger brands to scale, making the ecosystem dynamic and focused on technology and sustainability.

More Insights of Towards Packaging:

- Fresh Food Packaging Market Size, Trends, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, Value Chain & Trade Analysis, 2024-2035

- Centerfold Laminated Bag Market Size, Trends, Segments, Regional Outlook, Competitive Landscape, and Global Trade & Value Chain Analysis

- Display Packaging Market Size, Regional Outlook, Segments, Competitive Landscape, Value Chain & Trade Analysis, 2025-2035

- Hazardous Waste Bag Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competition, Value Chain & Trade Analysis, Manufacturers and Suppliers Landscape

- Dietary Supplement Packaging Market Size, Trends, Segments, Regional Analysis (NA, EU, APAC, LA, MEA), Manufacturers, Competitive Landscape & Value Chain Insights

- Zero Waste Packaging Market Size Outlook, Trends, Segments, Trade Statistics, Competitive Landscape & Value Chain Analysis

- PET Containers Market Size, Share, Trends, Segmentation, Regional Analysis (North America, Europe, Asia Pacific, Latin America, MEA), Competitive Landscape, Value Chain, Trade, Manufacturers & Suppliers, 2024-2035

- Chemicals Packaging Coding Equipment Market Size, Growth Trends, Segmentation, Regional Outlook, and Competitive Landscape Analysis

- Folding Cartons Market Size, Growth Trends, Segment Analysis, Regional Outlook, Competitive Landscape, Value Chain & Trade Dynamics, 2024-2035

- Easy Open Packaging Market Size, Trends, Segments, Regional Outlook, Competitive Landscape, and Global Trade Analysis

- Corrugated Fanfold Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Flexible Plastic Pouches Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, Value Chain & Trade Analysis, Manufacturers & Suppliers Insights, 2025-2035

- Packaging Resin Market Size, Segments, Regional Trends, Competitive Landscape & Global Trade Analysis 2024-2035

- Laminated Can Packaging Market Size, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape & Value Chain Analysis to 2035

- Electrostatic Discharge Packaging Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, Value Chain & Trade Analysis

- Biologics CDMO Secondary Packaging Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Analysis & Key Manufacturers 2025-2035

Segmental Insights

By Material Type

Paper-coated paper segment dominated the market because of its affordability, simplicity in printing, and adaptability to a variety of consumer goods. Due to its compatibility with most labeling equipment and support for high-quality graphics, it continues to be the preferred option for numerous industries, including food, pharmaceuticals, and beverages.

The plastic/synthetic PET segment is growing rapidly, motivated by its robustness, resistance to moisture, and elegant appearance. PET labels are being used more frequently by brands for high-end goods, beverages, and personal care items where longer product life and improved shelf appeal are crucial.

By Printing Technology

The flexographic printing segment dominated the primary packaging labels market because of its compatibility with a variety of substrates, efficiency in large-volume production, and comparatively lower cost per unit. It is a favored option for typical labeling applications due to its consistent ability to print colorful graphics.

The digital printing segment is growing rapidly, particularly for short-run, customized, or personalized labels. Its flexibility, quick turnaround, and ability to handle variable data printing have made it highly attractive for niche products, seasonal promotions, and limited-edition packaging.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

By Type of Label

The self-adhesive/pressure-sensitive label segment dominated the market due to its versatility, robust adhesion, and ease of use in a variety of materials and container shapes. Because of their dependability and simplicity of use, they are frequently utilized in food, beverage, and pharmaceutical packaging.

The shrink sleeve labels segment is growing rapidly due to its 360-degree surface coverage, vibrant graphics, and tamper-evident properties. They are increasingly used in the beverage, personal care, and cosmetic industries to enhance shelf visibility and consumer engagement.

By Application/ End Use Industry

The pharmaceuticals segment is dominating due to stringent safety, traceability, and labelling regulations. Barcoding compliance and dosage instructions all depend on accurate labeling, which makes this industry a steady source of demand.

Cosmetics and personal care are growing rapidly in the primary packaging labels market. Innovative label formats and materials are being adopted because of the industry's emphasis on high-end packaging, eye-catching designs, and brand differentiation.

By Packaging Type

The bottles segment is dominating the market due to their prevalence in beverages, pharmaceuticals, and personal care products. Labels for bottles are essential for branding, product information, and regulatory compliance, sustaining their strong market share.

Blister packs are growing rapidly, particularly in pharmaceutical and nutraceutical applications. The rise is driven by product protection, portion control, tamper evidence, and convenience for consumers, making them increasingly popular for tablets, capsules, and small consumer goods.

Regional Insights

Asia Pacific is dominating the primary packaging labels market because of favorable manufacturing costs, growing consumer goods demand, growing pharmaceutical and FMCG industries, and large production volumes. The area is still at the top in terms of label production and consumption. Innovative labeling solutions and packaged goods are in high demand due to growing urbanization and rising disposable incomes.

India Primary Packaging Labels Market Trends

India dominates the market because of rising production levels, rising consumer goods demand, and the growth of the FMCG and pharmaceutical industries. The market is growing as a result of increased urbanization, rising disposable incomes, and the quick uptake of contemporary packaging technologies.

North America is the fastest-growing region, driven by the uptake of new technologies, trends in high-end packaging, clever labeling techniques, and environmental projects. The digital and high-value label markets are expanding due to strict regulations and increased consumer awareness. Additionally, the region is seeing a rise in investments in digital printing technologies and environmentally friendly materials, which is driving market expansion.

U.S. Primary Packaging Labels Market Trends

The U.S. is the fastest growing, propelled using technology trends in high-end packaging level labeling techniques and sustainability programs. The label market is growing faster due to rising investments in digital printing, eco-friendly materials, and connected packaging.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Developments

- In October 2025, UPM Adhesive Materials introduced a “Premium Performance” label material collection for the wine & spirits packaging market, featuring advanced converting properties and premium finishings. These materials help brands achieve high-end aesthetics while reducing production waste.

- In August 2024, Henkel Adhesive Technologies unveiled sustainable pressure-sensitive adhesives compatible with recycling processes at LabelExpo 2024, targeting food packaging label recyclability. This development supports brands in meeting growing regulatory and consumer demands for circular packaging.

Top Companies in the Primary Packaging Labels Market & Their Offerings:

Tier 1:

- Avery Dennison Corporation provides a wide range of pressure-sensitive label materials, including sustainable films and papers, for various applications.

- CCL Industries Inc. is the world's largest label manufacturer, offering diverse decorative and instructional labeling solutions for global markets.

- Multi-Color Corporation specializes in global premium label solutions, providing comprehensive print technologies like pressure-sensitive, in-mold, and shrink sleeve labels.

- WestRock Company offers paper-based primary, secondary, and tertiary packaging solutions, including folding cartons and corrugated boxes, rather than labels.

- UPM Raflatac supplies high-performance, innovative self-adhesive paper and film label materials, with a strong emphasis on sustainable solutions, to label printers.

- SATO Holdings Corporation offers integrated auto-identification solutions, including a variety of high-quality thermal labels, tags, and printer systems for on-site printing.

- Constantia Flexibles Group GmbH focuses on flexible packaging production, offering film and foil-based solutions with features like digital printing and high barriers for food and pharma.

- Lintec Corporation is a comprehensive manufacturer of adhesive-related products, providing a wide array of adhesive papers and films for labels as well as application machinery.

-

Schreiner Group develops and produces innovative, high-tech, and multifunctional specialty labels and functional parts with integrated features for specific industries.

Tier 2:

- Huhtamaki Oyj

- MCC (Metalized Container Corporation)

- Arconvert S.A.

- CC Labels

- Printpack Inc.

- Optimum Group

- Flexcon Company, Inc.

- Taghleef Industries

- Fedrigoni Group

- Papeteries de Clairefontaine

- Essentra PLC

Segment Covered in the Report

By Material Type

- Paper

- Coated Paper

- Uncoated Paper

- Thermal Paper

- Others (e.g., recycled paper, specialty paper)

- Plastic / Synthetic

- Polypropylene (PP)

- Polyethylene (PE)

- Polyester (PET)

- PVC

- Others (e.g., polycarbonate, polylactic acid)

- Foil / Metallic

- Aluminum Foil

- Metalized PET

- Others

By Printing Technology

- Flexographic Printing

- Digital Printing

- Gravure Printing

- Screen Printing

- Offset Printing

- Others

By Type of Label

- Self-Adhesive / Pressure-Sensitive Labels

- Wet-Glue Labels

- Shrink Sleeve Labels

- In-Mold Labels (IML)

- Blister Labels

- Others

By Application / End-Use Industry

- Pharmaceuticals

- Food & Beverages

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Packaged Foods

- Dairy Products

- Others

- Cosmetics & Personal Care

- Consumer Goods / Household Products

- Chemical / Industrial Products

- Others

By Packaging Type

- Bottles

- Jars / Tubs

- Blister Packs

- Boxes / Cartons

- Cans / Tins

- Others

By Region

-

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

-

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

-

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

-

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Access our exclusive, data-rich dashboard dedicated to the primary packaging labels market built specifically for decision-makers, strategists, and industry leaders. The dashboard provides comprehensive statistical insights, segment-wise market breakdowns, regional performance analysis, detailed company profiles, annual updates, and much more. From accurate market sizing to in-depth competitive intelligence, this powerful tool serves as a complete one-stop solution for navigating opportunities in the primary packaging labels industry.

Access Now: https://www.towardspackaging.com/contact-us

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5775

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardspackaging.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Towards Packaging Releases Its Latest Insight - Check It Out:

- Cartoning Machines Market Size, Trends, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Benchmarking, Value Chain & Trade Analysis, Manufacturers and Suppliers Insights

- Anti-Static Packaging Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, Value Chain & Trade Analysis Report

- Ampule Sticker Labelling Machine Market Size, Trends, Segments, Regional Outlook, Competitive Analysis & Global Trade Insights

- Vacuum Sealing Machine Market Size, Trends, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA), Competitor Landscape & Value Chain Analysis

- Heavy Industry Packaging Market Size, Trends, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape & Value Chain Analysis

- Drugs Glass Packaging Market Size, Trends, Segments, Regional Analysis (NA, EU, APAC, LA, MEA), Competitive Landscape, Value Chain and Trade Insights

- Tamper Evident Labels Market Size, Trends, Segmentation, Competitive Landscape, Regional Insights & Value Chain Analysis

- High-Density Polyethylene (HDPE) Bottles Market Size, Trends, Segmentation, Regional Outlook, Competition & Industry Value Chain Report

- Roof Shape Aseptic Packaging Material Market Size, Trends, Segments, Regional Outlook, Competitive Landscape & Value Chain Analysis

- Ready-To-Eat Packaging Market Size, Segments, Regional Trends, and Competitive Landscape (2024-2034)

- Transparent Plastic Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- PET Blow Molder Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Multiwall Bags Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Beverage Carton Packaging Machinery Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

-

Customized Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.