Lead Optimization Services in Drug Discovery Market to Reach USD 10.26 Billion by 2034, Driven by Rising R&D Activity

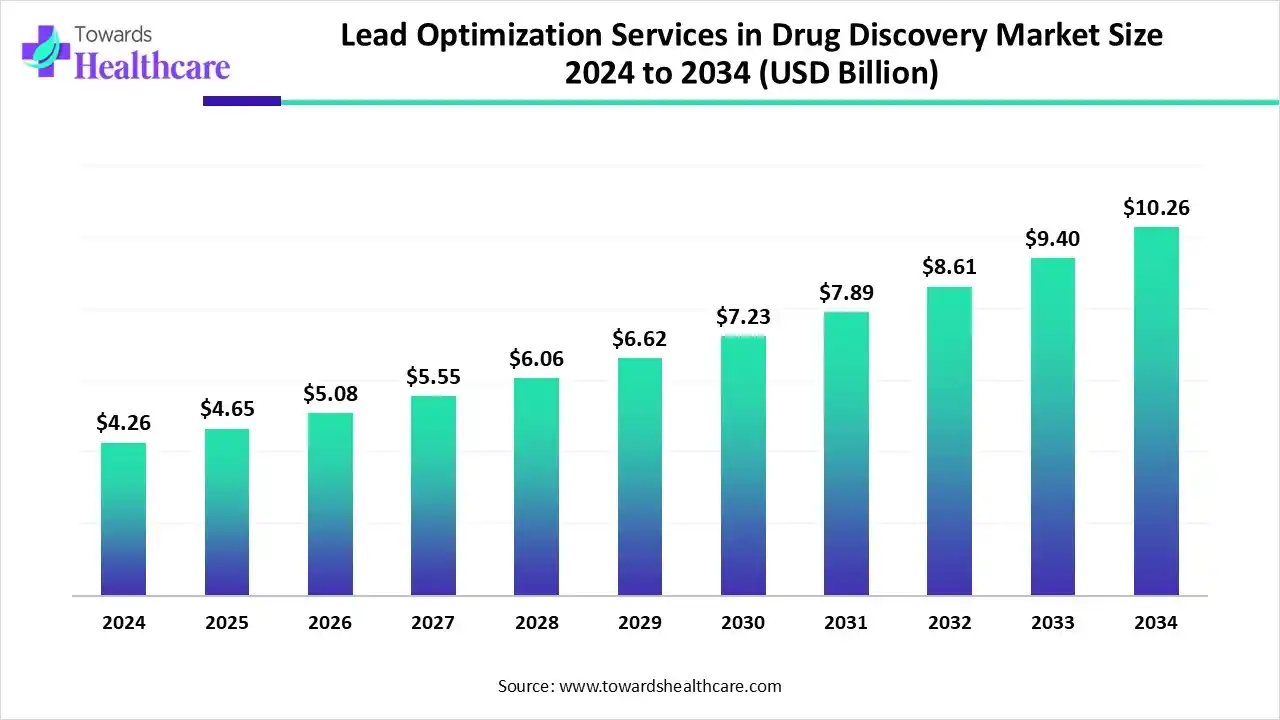

The global lead optimization services in drug discovery market size was valued at USD 4.26 billion in 2024 and is predicted to hit around USD 10.26 billion by 2034, rising at a 9.23% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Nov. 28, 2025 (GLOBE NEWSWIRE) -- The global lead optimization services in drug discovery market size is calculated at USD 4.65 billion in 2025 and is expected to reach around USD 10.26 billion by 2034, growing at a CAGR of 9.23% for the forecasted period, driven by the growing research and development activities.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6338

Key Takeaways

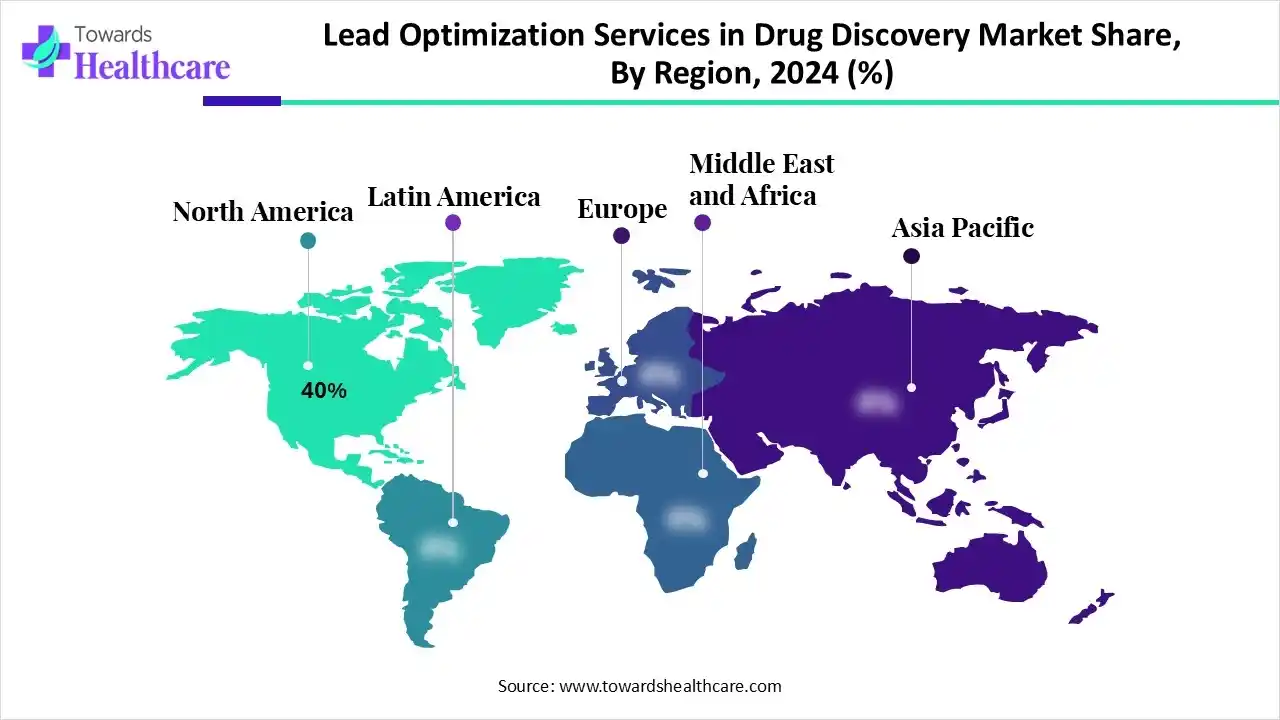

- North America held a major revenue of approximately 40% share of the market in 2024.

- Asia Pacific is expected to witness the fastest growth in the lead optimization services in drug discovery market during the forecast period.

- By service type, the medicinal chemistry services segment held a major revenue of approximately 40% share of the market in 2024.

- By service type, the computational & in silico services segment is expected to witness the fastest growth during the forecast period.

- By target molecule type, the small molecules segment held a major revenue of approximately 50% share of the market in 2024.

- By target molecule type, the peptides segment is expected to witness the fastest growth during the forecast period.

- By therapeutic area, the oncology segment held a major revenue of approximately 35% share of the market in 2024.

- By therapeutic area, the rare diseases segment is expected to witness the fastest growth during the forecast period.

- By end-user, the pharmaceutical companies segment held a major revenue of approximately 45% share of the market in 2024.

- By end-user, the contract research organizations (CROs) segment is expected to witness the fastest growth during the forecast period.

What are the Lead Optimization Services in Drug Discovery?

The lead optimization services in the drug discovery market are driven by the need to develop safer and more effective drug candidates efficiently. The lead optimization services in drug discovery encompass specialized activities that are used to enhance the potential drug candidate to make it suitable for preclinical and clinical development. These services help in enhancing the potency, selectivity, drug properties, reducing toxicity, and other side effects etc.

Quick Facts Table

| Table | Scope | |

| Market Size in 2025 | US$ 4.65 Billion | |

| Projected Market Size in 2034 | US$ 10.26 Billion | |

| CAGR (2025 - 2034) | 9.23 | % |

| Leading Region | North America by 40% | |

| Market Segmentation | By Target Molecule Type, By Therapeutic Area, By End-User, By Region | |

| Top Key Players | Labcorp Drug Development, Pharmaron, Jubilant Biosys, BioDuro, Medicilon, Covance (Labcorp), PPD (Thermo Fisher), Enamine, ChemPartner, Oncodesign, Accelera, Cerep (Eurofins), Aptuit (Evotec), Reaction Biology Corporation, Selvita | |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Major Growth Drivers in the Market?

Growing outsourcing trends are the major growth driver in the lead optimization services in the drug discovery market. The growing R&D activities are increasing their outsourcing to CRO in order to minimize their operational costs, leverage specialized expertise, and enhance the development timeline. Additionally, growing R&D investment, focus on complex therapeutics, and technological advancements are some of the other market drivers.

Market Outlook

Industry Growth Overview: The industry growth in the lead optimization services in drug discovery market is due to growing demand for outsourced R&D to enhance efficiency and minimize the high costs of drug discovery. Additionally, the technological advancements and increasing focus on complex areas like biological medicines and personalization are also contributing to the same.

Major Investors: The major investors include the large pharmaceutical industry and venture capital firms specializing in life sciences. They are focusing on acquiring specialized technologies, expertise, and offering their services.

Startup Ecosystem: The startup ecosystem in the lead optimization services in drug discovery market is focusing on developing and utilizing advanced technologies like artificial intelligence, machine learning to enhance the accuracy, efficiency, and speed of the design and refining new drug candidates.

What are the Key Drifts in the Market?

The lead optimization services in drug discovery market have been expanding due to the growing funding and investments to launch and enhance the use of various lead optimization services.

- In November 2025, a Series B-2 funding of $40 million was launched by Elephas Biosciences Corporation, which will be used to launch and commercialize its innovative live tumor profiling platform, that is Elephas Live™ Platform.

- In October 2025, an investment for Scindo, which is part of a £4 million funding round co-led by Kadmos Capital and Clay Capital, was announced by PINC to scale the enzyme discovery platform and wet lab operations of Scindo.

What is the Significant Challenge in the Market?

High cost acts as the major challenge in the lead optimization services in the drug discovery market. They often require well-developed infrastructure and resources for the synthesis and testing of the drugs, which limits their use by small companies. Moreover, technical complexities, long development timelines, and regulatory barriers are the other market restraints.

How do the AI Technological Shifts Impact the Market?

The AI in the lead optimization services in drug discovery market is transforming and accelerating the drug discovery process, as it offers various applications. It provides faster drug discovery and helps in selecting the drug candidate with higher efficacy and selectivity. At the same time, AI also helps in detecting the side effects or toxicity of the drug candidate, which in turn helps in enhancing their safety profile, and also promotes the development of personalized medicines depending on their genetic or phenotypic data.

For instance,

- In October 2025, to identify optimal receptor binding profiles for novel compounds, which were acquired by Oragenics, and to enhance the development of an expanded pharmaceutical-candidate portfolio for potential conditions affecting brain health, a collaboration between Oragenics and Receptor.AI was announced.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Table: Recently Launched Molecular Modeling Platforms

| Company | Platform | Application | Source |

| METiS TechBio | NanoForge | Nano-delivery discovery and design AI platform | METiS Launches World's First AI-Driven Nano-Delivery Platform NanoForge |

| Massachusetts Institute of Technology (MIT) Jameel Clinic for Machine Learning in Health | Boltz-2 | Predicts molecular binding affinity at enhanced speed and accuracy | Boltz-2 Released to Democratize AI Molecular Modeling for Drug Discovery |

| Viva Biotech | AI-Driven Drug Discovery (AIDD) platform | Accelerate the discovery of novel therapeutics with an intelligent, integrated, and efficient approach. | Viva Biotech Launches the AI-Driven Drug Discovery Platform, Transforming New Drug R&D Logic, Enabling One-Stop Innovative Drug Discovery |

| Qubit Pharmaceuticals | FeNNix-Bio1 | Simulate molecular interactions with unprecedented precision | Qubit Pharmaceuticals launches FeNNix-Bio1, a quantum AI model transforming drug discovery | Noah News |

| VantAI | Neo-1 | Systematic re-wiring of possible protein interactions | VantAI Launches Neo-1, the First AI Model to Rewire Molecular Interactions by Unifying Structure Prediction and Generation for Therapeutic Design |

Regional Analysis

Why did North America Dominate the Market in 2024?

In 2024, North America captured the biggest revenue share of 40% in the lead optimization services in drug discovery market, due to the presence of advanced pharmaceutical and biotechnology industries. Additionally, the presence of advanced infrastructure is also enhancing R&D activities, which has increased the use of lead optimization services. The growth in the R&D investment and use of advanced technologies also promoted their use. Moreover, the growing outsourcing trend and regulatory support also contributed to the market growth.

What Made the Asia Pacific the Fastest Growing Region in the Market in 2024?

Asia Pacific is expected to host the fastest-growing lead optimization services in drug discovery market during the forecast period, due to expanding pharmaceutical and biotechnology industries, which are enhancing their R&D activities. This is increasing the demand for affordable lead optimization services along with advanced technologies, driving their adoption rates. The government investment, funding, collaborations, and growing CROs are increasing the use of these services, which in turn is promoting the market growth.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights

By service type analysis

Why Did the Medicinal Chemistry Services Segment Dominate in the Market in 2024?

By service type, the medicinal chemistry services segment led the lead optimization services in drug discovery market with approximately 40% share in 2024, as it is the core function to improve the potency and safety of the products. The growth in the chemical modifications and optimization of ADME properties has also increased their use.

By service type, the computational & in silico services segment is expected to show the highest growth during the predicted time, due to growing drug discoveries. Additionally, the growing use of advanced technologies is also increasing their demand. Moreover, their rapid virtual screening is also encouraging their use.

By target molecule type analysis

Which Target Molecule Type Segment Held the Dominating Share of the Market in 2024?

By target molecule type, the small molecules segment held the dominating share of approximately 50% of the lead optimization services in drug discovery market in 2024, driven by their broad target coverage. Their high oral bioavailability has increased their demand. Their growing innovations also contributed to the increased demand for lead optimization services.

By target molecule type, the peptide segment is expected to show the fastest growth rate during the predicted time, due to its high specificity. This is increasing their R&D activities, which is increasing the demand for lead optimization services. The growing delivery technologies are also increasing their development, driving the demand for services.

By therapeutic area analysis

What Made Oncology the Dominant Segment in the Market in 2024?

By therapeutic area, the oncology segment led the lead optimization services in the drug discovery market with approximately 35% share in 2024, driven by its growing incidence. This increased their innovations, which contributed to the growth in the use of these services. The funding also supported their use.

By therapeutic area, the rare diseases segment is expected to show the highest growth during the upcoming years, due to their high unmet need. This is increasing their drug development and innovations. Additionally, the regulatory support is also accelerating their innovations and encouraging the use of lead optimization services.

By end-user analysis

How did the Pharmaceutical Companies Segment Dominated the Market in 2024?

By end-user, the pharmaceutical companies segment held the largest share of approximately 45% of the lead optimization services in drug discovery market in 2024, due to high R&D activities and investments. The expanding pipelines and outsourcing trends also increased the use of these services.

By end-user, the contract research organizations (CROs) segment is expected to show the fastest growth rate during the upcoming years, due to growing outsourcing trends. They also provide expertise and affordable services. Additionally, the use of advanced technologies accelerates drug development.

Recent Developments in the Market

- In November 2025, Nanoassaytm, which utilizes properties of single-walled carbon nanotubes (SWCNTs) for enzyme measurement, was launched by Zymosense, a leader in enzyme assay innovation.

- In June 2025, MERCURIUS™ Total DRUG-seq, which is a full-length transcriptome profiling library preparation kit used for high-throughput drug screens, target validation, and toxicology screens, was launched by Alithea Genomics.

Browse More Insights of Towards Healthcare:

The drug-induced dyskinesia market size is calculated at US$ 418 million in 2024, grew to US$ 436.2 million in 2025, and is projected to reach around US$ 627.5 million by 2034. The market is expanding at a CAGR of 4.34% between 2025 and 2034.

The global drug-loaded fat emulsion market size is calculated at US$ 2.34 billion in 2024, grew to US$ 2.62 billion in 2025, and is projected to reach around US$ 7.25 billion by 2034. The market is expanding at a CAGR of 12.04% between 2025 and 2034.

The global drug repurposing market size is calculated at US$ 636.95 million in 2025, grew to US$ 730.96 million in 2026, and is projected to reach around US$ 2506.64 million by 2035. The market is expanding at a CAGR of 14.76% between 2026 and 2035.

The global drug screening market size was estimated at US$ 6.15 billion in 2023 and is projected to grow to US$ 10.34 billion by 2034, rising at a compound annual growth rate (CAGR) of 4.84% from 2024 to 2034.

The global drug designing tools market size is calculated at US$ 3.4 in 2024, grew to US$ 3.7 billion in 2025, and is projected to reach around US$ 7.86 billion by 2034. The market is expanding at a CAGR of 8.73% between 2025 and 2034.

The global drug-eluting balloon catheters market size is calculated at US$ 1.42 billion in 2024, grew to US$ 1.58 billion in 2025, and is projected to reach around US$ 4.02 billion by 2034. The market is expanding at a CAGR of 11.1% between 2025 and 2034.

The drug-device combination products market size was estimated at US$ 150.3 billion in 2023 and is projected to grow to US$ 337.81 billion by 2034, rising at a compound annual growth rate (CAGR) of 7.64% from 2024 to 2034.

The global drug discovery platforms market size is calculated at USD 186.24 million in 2024, grew to USD 211.26 million in 2025, and is projected to reach around USD 635.45 million by 2034, growing at a 13.44% CAGR from 2025 to 2034.

The global drug discovery as a service market size is calculated at US$ 21.3 in 2024, grew to US$ 24.32 billion in 2025, and is projected to reach around US$ 79.82 billion by 2034. The market is expanding at a CAGR of 14.17% between 2025 and 2034.

The global drugs market size recorded US$ 1688.14 billion in 2025, set to grow to US$ 1790.05 billion in 2026 and projected to hit nearly US$ 3034.63 billion by 2035, with a CAGR of 6.04% throughout the forecast timeline.

The global topical drugs CDMO market size is calculated at US$ 46.32 in 2024, grew to US$ 51.62 billion in 2025, and is projected to reach around US$ 136.71 billion by 2034. The market is expanding at a CAGR of 11.43% between 2025 and 2034.

Market Value Chain Analysis

R&D

The incorporation of advanced technologies like AI for efficient and rapid testing, identifying, and refining potential drug candidates for improving the safety, efficacy, and drug-like properties is the focus of the lead optimization services in drug discovery R&D.

Key players: Charles River Laboratories, WuXi AppTec, Evotec SE, Labcorp Drug Development.

Preclinical Trials Approvals

The preclinical trials approvals in the lead optimization services in drug discovery focus on developing a drug with optimized properties, extensive animal testing, and toxicology studies before clinical trials.

Key players: Charles River Laboratories, WuXi AppTec, Evotec SE, Labcorp Drug Development, ICON plc.

Patient Support and Services

The lead optimization services in drug discovery do not offer direct patient support and services, but are involved in developing safe and effective treatments for the patients.

Key players: Charles River Laboratories, WuXi AppTec, Evotec SE, Labcorp Drug Development, Sygnature Discovery.

Top Vendors and Their Offerings

- WuXi AppTec: The company offers services such as humanization, affinity optimization, pH dependency, Fc selection and engineering, and developability improvement.

- Charles River Laboratories: Services for LogP and LogD profiles, in vivo PK and ADME profiles, metabolic liabilities profiles, selectivity profiling and optimization, etc, are offered by the company.

- Evotec SE: Hit identification service, structural biology service, molecular design and medicinal chemistry, etc., are the services provided by the company.

- Sygnature Discovery: The lead optimization capabilities of the company involve internal efficiency, data generation, experience and innovative solutions, track record, route development, scale-up, and formulation expertise.

- Eurofins Scientific: The lead optimization services of the company focus on ADME toxicology, safety pharmacology, in vivo pharmacology, translational biology, and integrated drug discovery.

Which are the Top Companies in the Lead Optimization Services in Drug Discovery Market?

- Jubilant Biosys

- Labcorp Drug Development

- BioDuro

- Pharmaron

- PPD (Thermo Fisher)

- Medicilon

- Enamine

- Covance (Labcorp)

- Accelera

- Selvita

- ChemPartner

- Aptuit (Evotec)

- Oncodesign

- Reaction Biology Corporation

- Cerep (Eurofins)

Segments Covered in The Report

By Service Type

- Medicinal Chemistry Services

- Hit-to-Lead Optimization

- Structure-Activity Relationship (SAR) Analysis

- Lead Generation & Design

- Computational & In Silico Services

- Molecular Modeling & Docking

- QSAR/ADME-Tox Prediction

- Virtual Screening

- Biochemical & Cellular Profiling

- Enzyme Assays

- Receptor Binding Studies

- Cellular Activity Profiling

- ADME/Toxicology Services

- Metabolic Stability Testing

- Cytotoxicity Screening

- Pharmacokinetic Assessment

- Others

By Target Molecule Type

- Small Molecules

- Peptides

- Biologics/Proteins

- Others

By Therapeutic Area

- Oncology

- Cardiovascular Diseases

- CNS/Neurology

- Infectious Diseases

- Autoimmune/Immunology

- Metabolic Disorders

- Rare Diseases

- Others

By End-User

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutions

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

South America

- Brazil

- Argentina

- Rest of South America

Europe

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/download-sample/6338

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.