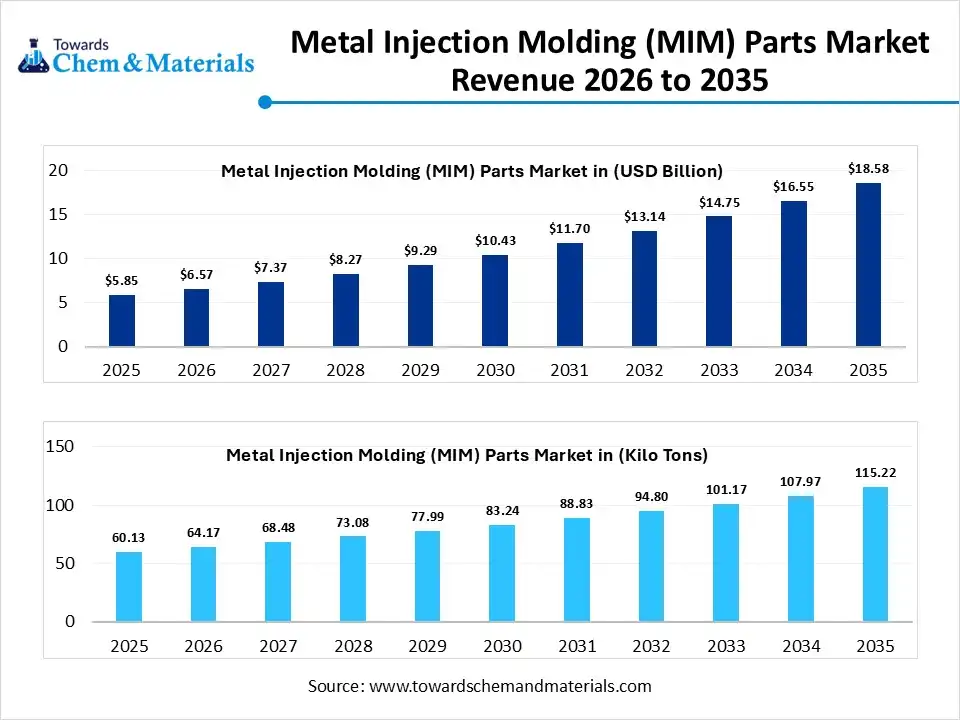

Metal Injection Molding (MIM) Parts Market Volume Worth 115.22 Kilo Tons by 2035

According to Towards Chemical and Materials, the global metal injection molding (MIM) parts market volume was valued at 60.13 kilo tons in 2025 and is expected to be worth around 115.22 kilo tons by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.72% over the forecast period from 2026 to 2035.

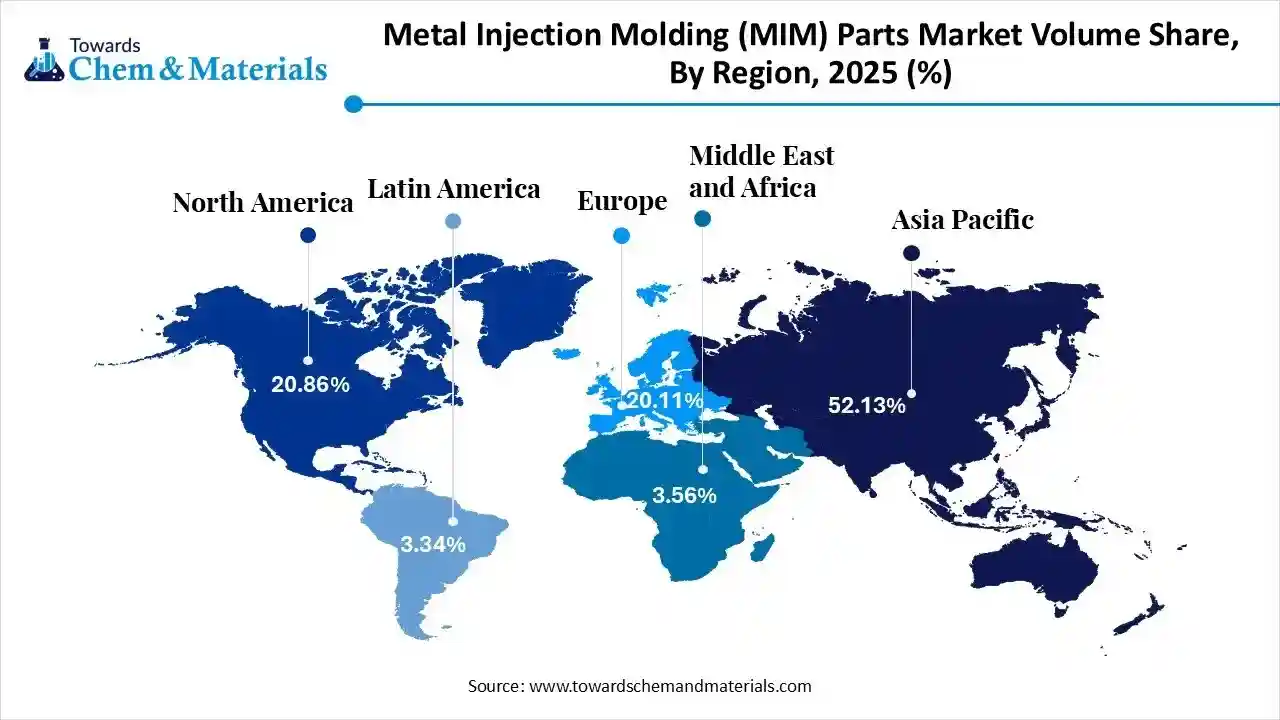

Ottawa, Feb. 03, 2026 (GLOBE NEWSWIRE) -- The global metal injection molding (MIM) parts market size was estimated at USD 5.85 billion in 2025 and is expected to increase from USD 6.57 billion in 2026 to USD 18.58 billion by 2035, growing at a CAGR of 12.25%. In terms of volume, the market is projected to grow from 60.13 kilo tons in 2025 to 115.22 kilo tons by 2035. exhibiting at a compound annual growth rate (CAGR) of 6.72% over the forecast period 2026 to 2035. The Asia Pacific dominated metal Injection Molding (MIM) parts market with the largest volume share of 52.1% in 2025. The market is driven by material innovation, emphasis on miniaturization, industrial use, technological advancement, and sustainability efforts. A study published by Towards Chemical and Materials, a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6150

Revolutionizing MIM with Precision and Innovation

The metal injection molding parts are produced by combining the design flexibility of plastic injection molding techniques with powder metallurgy, with key properties like high complexity, precision, and scalability, especially for small, intricate components for large-scale production. Its durability and excellent precision are driving its demand in automotive, consumer electronics, defence, and medical and Medical & dental sectors.

Metal Injection Molding (MIM) Parts Market Report Highlights

- The Asia Pacific dominated the global metal injection molding (MIM) parts market with the largest volume share of 52.1% in 2025.

- The metal injection molding (MIM) parts market in North America is expected to grow at a substantial CAGR of 8.65% from 2026 to 2035.

- The Europe metal injection molding (MIM) parts market segment accounted for the major volume share of 20.11% in 2025.

- By material type, the stainless-steel segment dominated the market and accounted for the largest volume share of 53.8% in 2025.

- By material type, the tool steel segment is expected to grow at the fastest CAGR of 10.29% from 2026 to 2035 in terms of volume.

- By end-use industry, the electrical & electronics segment led the market with the largest revenue volume share of 34.2% in 2025.

- By component weight, the small parts segment dominated the market and accounted for the largest volume share of 48.5% in 2025.

- By debinding technology, the catalytic debinding segment led the market with the largest revenue volume share of 55.00% in 2025.

Metal Injection Molding (MIM) Parts Market Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 6.57 Billion / 64.17 Kilo Tons |

| Revenue Forecast in 2035 | USD 18.58 Billion / 115.22 Kilo Tons |

| Growth Rate | CAGR 12.25% |

| Forecast Period | 2026 – 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Coating Type, By Resin Type, By Application Area, By End-Use Sector, By Region |

| Key companies profiled | ArcelorMittal S.A, China Baowu Steel Group, Nippon Steel Corporation, POSCO Hold |

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Private Industry Investments for Metal Injection Molding (MIM) Parts:

- Indo-MIM Major IPO: The industry leader received regulatory approval in January 2026 for a ₹1,000 crore fresh issue to expand its global production capacity across 6,400 different product types.

- Biomerics MIM Center of Excellence: In late 2025, medical device giant Biomerics launched a dedicated MIM facility to provide vertically integrated production of complex micro-metal components for surgical instruments.

- ThinkMetal Venture Funding: This startup secured $800,000 in Pre-Series A funding led by YourNest Venture Capital to advance its digital-first approach to traditional metal injection molding.

- Precision Manufacturing Consolidation: A global manufacturing group acquired a specialist MIM firm in November 2025 to integrate advanced near-net-shape production capabilities into its aerospace division.

- Automotive Supply Chain Partnership: In August 2025, a major automotive supplier invested in a strategic partnership with a MIM provider to scale up the production of high-volume, complex engine and transmission components.

- Private Equity Regional Buyout: A private equity firm acquired a regional MIM manufacturer in mid-2025 to provide the capital necessary for entering the high-growth medical and electronics consumer markets.

What Are Major Trends in the Metal Injection Molding (MIM) Parts Market?

- Focus on Sustainability: The shift towards the recycling of feedstocks and the advancement of eco-friendly water-soluble binder systems to reduce carbon footprint and environmental impact, fueling this trend.

- Rising Demand for Miniaturization and Micro-MIM: The trend is driven by the requirement for small, intricate parts in robotic surgery tools, micro-electronics, and wearable sensors due to the focus on creating ultra-small, high-complexity components.

-

Growth of Electric Vehicles (EVs): the automotive industry transition to electrification is driving the MIM adoption for lightweight and complex parts in battery systems and specialized systems.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6150

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Metal Injection Molding (MIM) Parts Market Dynamics

Driver

Focus on Hybrid Manufacturing

The manufacturers using 3D-printed MIM mold inserts that combine with binder jetting bridge the gap from rapid prototyping to large-scale production, used for complex mold prototyping. Overall, hybrid manufacturing significantly reduces production cycle time and improves part quality.

Restraints

Long Operation Times and Shortage of Skilled Labor

The MIM show multi-stage process that takes long lead times, including mold fabrication, sintering, which extends production cycles and MIM operations required specialized workforce for thermal and metallurgical processing, which retraining the market expansion.

Opportunity

Material Replacement in Aerospace Fasteners:

The market players focus on the replacement of heavy machined fasteners with lightweight and MIM-produced superalloys, driving the opportunity for MIM to accelerate near-zero-waste production, offering high-performance materials like titanium, and optimizing their global supply chain by offering sustainable and cost-effective alternatives for aerospace.

Optimizing MIM Operations Through Technological Solutions

The integration of technology and AI enables high-precision manufacturing ecosystems. The AI-driven generative design enables shrinkage control and cooling optimization. The shift towards machine learning analyzes the injection cycle and thermal gradients, while digital twins allow manufacturers for lifecycle with energy optimization. Additionally, AI-enabled rheometer systems are used to monitor the flowability of feedstock through the integration of smart feedstock management.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6150

Metal Injection Molding (MIM) Parts Market Segmentation Insights

Segmental Insights

Material Type Insights

How Did the Stainless-Steel Segment Dominate the Metal Injection Molding (MIM) Parts Market?

The stainless-steel segment maintains its dominance in the market because of its corrosion resistance, mechanical strength, and versatility. The material is ideal for producing intricate, net-shape parts that endure harsh environments, from high-pressure automotive sensors to surgical tools. Its adoption is boosted by specialized grades offering wear resistance and biocompatibility, meeting strict performance standards that ensure its continuous dominance for complex molded components.

The tool steel segment is anticipated to grow fastest, driven by industry needs for components with toughness, thermal properties and superior abrasion resistance, making it crucial for advanced industrial tooling and heavy-duty parts with reduced costs and material efficiency, delivering parts with high surface hardness. Additionally, demand for high-performance machinery and hardware is fueling innovation in tool steel.

End-Use Industry Insights

Which End-Use Industry Segment Dominates the Metal Injection Molding (MIM) Parts Market?

The electrical & electronics segment is leading the market, driven by device miniaturization and increased functional complexity. MIM enables mass production of high-strength, intricate parts like structural frames, connectors, and heat sinks, pivotal for modern hardware. The industry's transition toward complex electronics architectures enhances this segment's prominence, integrating geometries and specialized metal alloys to boost device performance and longevity.

The medical & healthcare segment offers significant growth during the projected period, driving innovation in MIM, especially for minimally invasive surgery and robotic platforms. The technology is vital for creating miniature, strong parts like surgical grippers and joints with complex shapes. Using biocompatible alloys, manufacturers produce high-density, sterile parts that combine multiple functions. Additionally, this improves surgical precision and cuts assembly costs, making healthcare a key market for advanced metal fabrication.

Component Weight Insights

How did the small parts Segment Dominate the Metal Injection Molding (MIM) Parts Market?

The small parts segment dominates the market, driven by a global shift toward miniaturization in high-technology sectors. The MIM's efficiency in producing intricate parts in multi-cavity molds by reducing costs enables mass production. Smaller parts also experience superior thermal uniformity, lightning properties ensuring structural integrity, and a high-quality surface finish. This suitability makes them dynamic for surgical tools, mobile device hardware, and sensor housings.

The micro parts segment is an emerging segment projected to grow at a CAGR between 2026 and 2035 due to industries' shift to ultra-miniaturization and high-density functions. The demand for sub-millimetre components in medical robotics, sensors, and micro-electronics requires exceptional mechanical strength in small spaces. Metal injection molding can mass-produce these complex geometries with net-shape precision, avoiding costly post-processing, forming the foundation for next-generation compact technology.

Debinding Technology Insights

Why did the Catalytic Debinding Segment Dominate the Metal Injection Molding (MIM) Parts Market?

Catalytic debinding offers a game-changing solution for binder removal. This ensures excellent dimensional stability and prevents defects like warping. Operating at low temperatures, it preserves delicate geometries and speeds up processing, faster than pyrolysis. Its ability to produce complex, thick-walled parts with high accuracy, driving catalytic debinding the standard for high-volume manufacturing.

The water-based debinding segment is experiencing the fastest growth in the market during the projected period. The industry emphasizes sustainability and safety. It replaces hazardous solvents and high-energy thermal processes with a cleaner, cost-effective aqueous method. Water-based systems provide better precision for delicate parts, reducing internal stress and deformation.

Regional Insights

How did Asia Pacific Dominate the Metal Injection Molding (MIM) Parts Market?

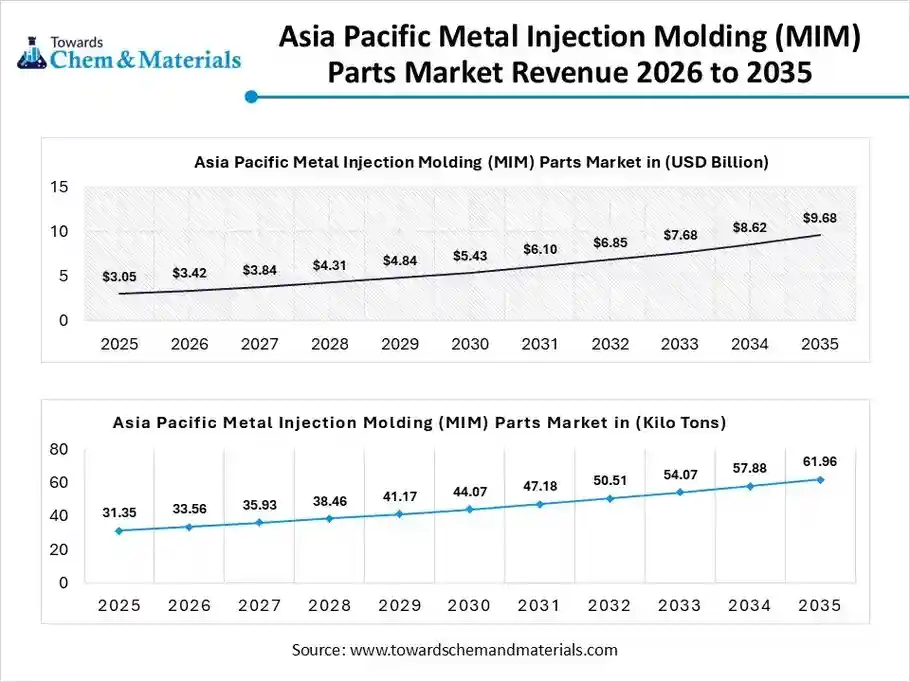

The Asia Pacific metal injection molding (MIM) parts market size was valued at USD 3.05 billion in 2025 and is expected to be worth around USD 9.68 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 12.27% over the forecast period from 2026 to 2035. The Asia Pacific metal injection molding (MIM) parts market volume was estimated at 31.35 kilo tons in 2025 and is projected to reach 57.86 kilo tons by 2035, growing at a CAGR of 7.05% from 2026 to 2035. Asia Pacific dominated the market with a 52.1% share in 2025.

The Asia Pacific region leads the market, supported by widespread manufacturing infrastructure and a focus on fast-growing sectors. This dominance is driven by large volumes of consumer electronics and automotive parts in the regional landscape, aligning with MIM technology's capabilities. The growth is also fueled by a sophisticated, cost-effective supply chain and government initiatives to modernize industry and adopt advanced manufacturing standards.

Chinese Metal Injection Molding (MIM) Parts Market Trends

China's market is growing rapidly, supported by strong demand from the electronics, automotive, medical device, and consumer goods industries. The need for miniaturized, high-precision, and lightweight components, especially for smartphones, electric vehicles, and wearable devices, is accelerating MIM adoption.

Why is North America the Fastest-Growing Region in the Metal Injection Molding (MIM) Parts Market?

The North America market is anticipated to grow at the fastest CAGR during the forecast period, driven by advancements in the medical field for robotic surgery, aerospace & defence sectors. As companies focus on reshoring supply chains and adopting automated, sustainable processes, North America is strengthening its leadership in complex manufacturing and promoting the use of MIM for lightweight engine parts and sensor housings.

U.S. Metal Injection Molding (MIM) Parts Market Trends

The U.S. market is growing steadily, driven by rising demand for lightweight, high-strength, and complex components in automotive, medical, consumer electronics, defense, and industrial applications. Manufacturers are increasingly adopting MIM to produce small, intricate parts that are difficult or costly to make using traditional machining methods.

More Insights in Towards Chemical and Materials:

Asia Pacific Antimicrobial Plastic Market Size to Hit USD 39.44 Billion by 2035

Antimicrobial Plastic Market Size to Hit USD 109.50 Billion by 2035

Plastic Waste Pyrolysis Oil Market Size to Hit USD 1,365.54 Mn by 2035

Chemical Recycling of Plastics Market Size to Hit USD 47.60 Bn by 2035

Bioplastic Textiles Market Size to Hit USD 34.53 Billion by 2035

Bioplastic Compounding Market Volume to Hit 12.54 Million Tons 2035

Bioplastics in Diagnostic Devices Market Size to Hit USD 879.46 Million by 2035

Bioplastics In Medical Devices Market Size to Surpass USD 6.73 Billion by 2035

Asia Pacific Plastic Resin Market Size to Surpass USD 704.98 Bn by 2035

Plastic Resin Market Size to Surpass USD 1,384.76 Billion by 2035

Thermoplastic Polyimides Market Size to Hit USD 1,926.61 Mn by 2035

Europe Biodegradable Plastics Market Size to Reach USD 39.50 Bn by 2035

U.S. Bioplastics Market Size to Reach USD 21.84 Bn by 2035

Aerospace Plastics Market Size to Worth Around USD 23.28 Bn by 2035

Europe Bioplastics and Biopolymers Market Size to Reach USD 34.37 Bn by 2035

U.S. Bioplastics and Biopolymers Market Size to Surpass USD 34.37 Bn by 2035

Plastic Processing Machinery Market Size to Hit USD 41.40 Bn by 2035

Europe Recycled Plastics Market Size to Surpass USD 33.84 Bn by 2035

Asia Pacific Recycled Plastics Market Size to Surpass USD 72.11 Bn by 2034

Recycled Engineering Plastics Market Size to Hit USD 7.89 Billion by 2034

Plastic Waste Management Market Size to Hit USD 56.65 Billion by 2035

Mechanical Recycling of Plastics Market Size to Surge USD 92.86 Bn by 2034

Recycled Plastic Pipes Market Size to Hit USD 20.08 Billion by 2034

Carbon Fiber Reinforced Plastic (CFRP) Market Size to Surge USD 48.08 Bn by 2034

Plastic Hot and Cold Pipe Market Size to Hit USD 14.93 Bn by 2034

Metal Injection Molding (MIM) Parts Market Top Key Companies:

Top Market Players in Metal Injection Molding (MIM) Parts Market & Their Offerings:

Tier 1:

- Smith Metals: High-precision components under 100g for the electronics, medical, and firearms sectors.

- Indo-MIM Pvt. Ltd.: End-to-end, high-volume production of complex parts for automotive and aerospace.

- Phillips-Medisize (Molex): Precision-shaped metal parts for regulated medical and defense industries.

- Parmaco Metal Injection Molding AG: Swiss specialist focused on micro-MIM for extremely small, high-accuracy parts.

- CMG Technologies: Complex 3D geometries and design support for the UK industrial and aerospace markets.

- Advanced Materials Technologies: Innovative bi-material and hollow-core components for automotive and medical use.

-

Dynacast: Consistent, small-scale metal parts leveraging extensive expertise in precision metallurgy.

Tier 2:

- Schunk Group

- Epson Atmix

- Future High-Tech Co., Ltd.

- Sintex

- Advanced Powder Products, Inc.

- Micro-MIM

- Zoltrix Material

- Mimest S.p.A.

- Sturm, Ruger & Co. (MIM Division)

- PolyMIM GmbH

- GKN Powder Metallurgy

- PSM Industries

Recent Breakthroughs in Metal Injection Molding (MIM) Parts Industry

- In April 2025, OptiMIM and India-based Vasantha Tool Crafts announced a strategic joint venture named OptiMIM Global to expand market reach and innovation in advanced metal injection molding for diversified industry applications. The tools are designed to improve efficiency, precision, and cost-effectiveness.

https://www.prnewswire.co.uk/news-releases/optimim-and-vasantha-tool-crafts-pvtltd-announce-strateg…

Metal Injection Molding (MIM) Parts Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Metal Injection Molding (MIM) Parts Market

By Material Type

- Stainless Steel

- Austenitic (316L, 304L)

- Martensitic (420, 440C)

- Precipitation Hardening (17-4PH, 15-5PH)

- Low Alloy Steels

- Fe-Ni Alloys (Fe-2Ni, Fe-7Ni)

- 4140, 4605, 8620

- Soft Magnetic Materials

- Pure Iron

- Fe-Si Alloys

- Fe-Ni Alloys

- Tool Steels

- M2, D2, H13

- Specialty Alloys

- Titanium and Titanium Alloys (Ti6Al4V)

- Cobalt-Chrome (Co-Cr) Alloys

- Tungsten Heavy Alloys

- Copper and Copper-based Alloys

- Superalloys (Inconel, Hastelloy)

By End-Use Industry

- Medical & Healthcare

- Surgical Instruments (Forceps, Scalpel Handles)

- Orthodontic Brackets and Dental Tools

- Implantable Devices

- Diagnostic Equipment Components

- Electrical & Electronics

- Smartphone Frames and Internal Brackets

- Camera Lens Mechanisms

- Wearable Device Components (Watch Cases, Sensors)

- Laptop and Tablet Hinges

- Connectors and Fiber Optic Hardware

- Automotive

- Fuel Injection System Parts

- Turbocharger Components (Vanes, Actuators)

- Interior Safety Systems (Seat Belt Parts, Airbag Components)

- Lock and Latch Mechanisms

- Sensor Housings and Small Gears

- Firearms & Defense

- Triggers and Hammers

- Sights and Rail Systems

- Safety Levers and Bolts

- Firing Pins

- Industrial Machinery & Tools

- Power Tool Components (Gears, Chucks)

- Pneumatic and Hydraulic Valve Parts

- Textile Machinery Components

- Pump Rotors and Nozzles

- Aerospace

- Engine Blade Fasteners

- Navigation System Hardware

- Lightweight Structural Brackets

- Consumer Goods

- Eyewear Hinges and Frames

- High-end Watch Straps and Cases

- Luxury Hardware (Zippers, Buckles)

- Sporting Goods (Golf Club Inserts)

By Component Weight

- Micro Parts (Less than 0.1g)

- Small Parts (0.1g to 10g)

- Medium Parts (10g to 50g)

- Large Parts (Greater than 50g)

By Debinding Technology

- Catalytic Debinding

- Thermal Debinding

- Solvent Debinding

- Water-based Debinding

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6150

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.